Basic concepts

1. Factors of production:

The factors that are used in production are called factors of production. The factors are: land, labor, capital an organization. For the contribution made by factors of production, they are paid the amounts the factors of production obtains are called factor incomes. The factor incomes are rent, wage, interest and profit. The factor incomes are also called factor costs. They are parts of national income. It we sum up the factor incomes of the country we obtain national income.

a. Factors of production : land, labor, capital , organization

b. Factor incomes: rent, wage , interest, profit

2. Transfer of payments

The payments or receipts without contribution in production are called transfer of payments. Some of the examples are pension, subsidies, indirect taxes, windfall gains, grants, allowances paid to old aged, handicapped; under privileged people etc. it is not part of national income

3. Final products

The products directly consumed by final consumers are called final products. The final products are parts of national income. Their monetary values are distributed in forms of factor incomes. The goods and services used as raw materials, fuels or energies for the production of other goods and services are called intermediary goods or products. They are not added to measure the national income.

Basic concept of national income accounting

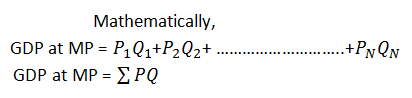

1. Gross domestic product at market price ( GDP at MP )

GDP at MP is the sum of monetary values of all final products of a country in a year. The monetary value of each product is obtained multiplying the quantity and price of the product.

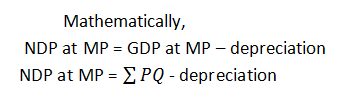

2. Net domestic product at market price (NDP at MP)

NDP at MP is the net monetary value of final products produced in a year in a country. It we subtract depreciation from GDP at MP we obtain NDP at MP.

3. Net national product at market price(NNP at MP)

If we add net factor income from abroad to NDP at MP we obtain NNP at MP. Here the factor income means rent wage, Interest and profit. For it we factor income earned from rest of the world but subtract the factor income earned by rest of the world from our country.

Mathematically,

NNP at MP = NDP at MP + net factor income from abroad

4. Net national product at factor cost (NNP at FC):

If we subtract net indirect tax from NNP at MP we obtain NNP at FC.

Mathematically,

NNP at FC = NNP at MP – net indirect tax

NNP at FC = NNP at MP – (indirect tax-subsidies)

NNP at FC is the national income…

5. Private income

Private income is the income of people and private business organization of the country. If we subtract government’s income from national income we obtain private income.

Mathematically,

Private income = NI-GOVT’S INCOME

Here,

The government’s income means rent, profit and interest earned by government. However, there is transfer of payments from government to private sector and from private sector to government. They are adjusted subtracting the transfer of payment from private sector to government and adding the transfer of payment from government to the private sector including individuals. Besides it, the corporate taxes are also subtracted from national income to obtain private income.

Mathematically,

Private income = NI- factor income of govt-corporate taxes-transfer of payments to govt+transfer of payment from government

6. Personal income

The income of individual in total is called personal income. It includes all factor incomes earned by people of the country. Moreover, it includes the transfer of payments from government and business organizations too. But, the transfers of payment from people to government are subtracted to find it.

Mathematically,

Personal income = private income-undistributed profit

7. disposable income:

The personal income left after the payment of direct taxes is called disposable income. The direct taxes are income tax, house tax, land tax etc.

Mathematically,

Disposable income= personal income-direct tax

If the people pay other social security contribution or charges they too should be subtracted to obtain disposable income

Mathematically,

Disposal income= personal income-direct tax-social security contribution

8. per capita income:

It is the ratio of national income and population size. it is known as national income per head of the country

Methods of measuring national income:

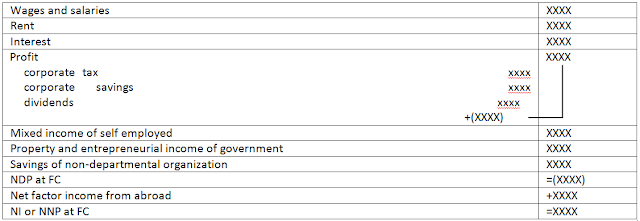

1. Income method:

In this method, we measure national income on the basis of factor incomes of people, business organization and the government of the country. The factor incomes mean rent, wage, interest and profit. These are the payments made to or received by land, labor, capital and organization respectively and is used in the country in a year. Moreover, we add net factor incomes earned from abroad. There are people self-employed too. Their income is in mixed form. That’s; why, it is added separately. Profit, interest and rent earned by government in a year is added as property and entrepreneurial income of government. The savings of non-departmental organizations too is added separately as factor income. The sum of factor incomes in the country gives NDP at FC. To NDP at FC we add net factor income from abroad and we get NNP at FC or NI as following.

2. Expenditure method

In this method, national income is calculated summing up the expenditures of household sector, business sector, government sector and foreign trade sector. The expenditures of these sectors are called consumption expenditure, investment expenditure, government expenditure and net export. However, the expenditure may be on goods produced in previous years. That’s why; we adjust it subtracting opening inventory and adding closing inventory. If we sum op the expenditures we obtain GDP at MP .then from GDP at MP we subtract depreciation and net indirect tax as following to get NI

| Consumption expenditure of household sector | XXXX |

| Government expenditure on final goods | XXXX |

| Investment expenditure ( private +public) | XXXX |

| Foreign trade sector (export-import) | XXXX |

| Change in inventory (closing-opening) | XXXX |

| Gross domestic product at market price | XXXX |

| Less: depreciation | XXXX |

| Net factor income from abroad | XXXX |

| Less: net indirect tax | XXXX |

| National income | XXXX |

3. Product method:

In this method, we measure NI on the basis of monetary values of final products or value added in each stage of production and distribution. The economy (country) is divided into 3 different sectors namely: primary, secondary, tertiary.

Primary: agriculture, forestry, livestock rearing etc.

secondary: health, sanitation, transportation, education etc

tertiary: tourism, sports, music etc.

Types of method

A. Final product method

In this method, NI is measured on the basis of monetary values of final product. Firstly, we find monetary values of final product of primary, secondary and tertiary sectors. Sum of the final products gives GDP at MP. To GDP at MP we add net factor income from abroad and from it we subtract depreciation and net indirect tax to find NI.

| Final product of primary sector | XXXX |

| Final product of secondary sector | XXXX |

| Final product of tertiary sector | XXXX |

| GDP at MP | XXXX |

| Depreciation | XXXX |

| Net indirect tax | XXXX |

| Net factor income from abroad | XXXX |

| NI | XXXX |

B. value added method:

In this method, NI is measured adding the values added in each stage of production and distribution. Firstly we add values added in primary, secondary and tertiary sectors. Sum gives GDP at FC. From that we subtract depreciation and to it we add net factor income from abroad to find NI.

| Value added in primary sector | XXXX |

| Value added in secondary sector | XXXX |

| Value added in primary sector | XXXX |

| GDP at FC | XXXX |

| Depreciation | XXXX |

| Net factor income from abroad | XXXX |

| NI | XXXX |

Thus, these are the methods of measuring national income

Difficulties while measuring national income

1. Non-monetary transactions

There are many non monetary income and output in developing countries like owner occupied house, self consumed agriculture products etc. due to non monetary nature they aren’t included in national income

2. Problems of double counting

Only final goods and services should be included in national income. But it is arduous to distinguish between final goods and intermediate goods. Intermediate goods also can be used for final consumption. There are possibilities of double counting

3. Underground economy

Under ground economy consists of illegal transactions like drugs, gambling, smuggling etc. they are not included in national income thus income become less than actual amount

4. Petty production

There are large numbers of petty producers and it is difficult to include their production in national inco

me because they don’t maintain any account.

5. Public services

Public services like general administration, police, and army services are difficult to evaluate and they become hard to include in national income accounting

6. Illiteracy and ignorance

If majority of people are illiterate and ignorant, they can’t keep the records of production activities accurately. Hence, it is difficult to get correct information.

7. Capital gains or losses

When price of any assets alters then owner can make gains or losses. Such gains or losses are not included in national income.

8. Wages and salaries paid in kind

Payments made in kind mayn’t be included in national income. But facilities given in kind are calculates as supplements of wages and salaries on the income side

9. Conceptual problem

The major obstacles is whether to include the income generated within country or even generated abroad in national income and which method should be used in measuring national income

10. Transfer payments

Individual get pension, unemployment, allowance, windfall gains, subsidies on many measures , but they create difficulty in the measurement of national income.

Thus, these are the difficulties in measuring national income.

Top comments (0)