Since the start of Sunday’s trading session, stocks have been under pressure. In the morning, the Nepal Stock Exchange (Nepse) index plummeted 43 points.

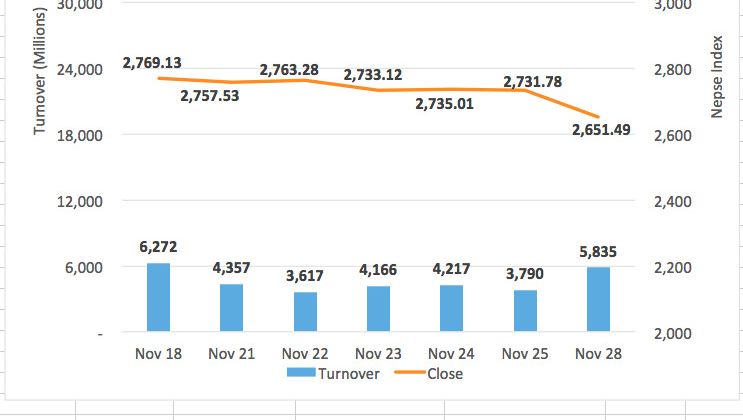

The market extended its fast fall, losing 80.29 points to close at 2,651.49, after a brief recovery attempt before midday.

While the market was flat before of the monetary policy review, it reacted with a sharp drop when it was announced. Even though there were no negative adjustments in the review, the much-anticipated amendment to the loan-to-share limit was also absent.

As a result, mood remained pessimistic throughout the day. Furthermore, heavy selling pressure from specific brokers exacerbated the day’s decline. The company’s revenue was close to Rs. 6 billion.

All sectors had significant drops, with the Trading and Development bank sub-indices each losing more than 5%. The sub-indices for Hotels & Tourism and Hydropower both fell more than 4%. All other sectors experienced a strong closing to the downside.

The day’s actives were Mahalaxmi Bikas Bank Ltd and Nepal Reinsurnace Company Ltd, with turnovers of Rs. 298 million and Rs. 235 million, respectively.

Other participants included National Hydropower Company Ltd, Nepal Telecom Ltd, Nirdhan Utthan Laghubitta Bittiya Sanstha Ltd, and Api Power Company Ltd.

In the last minutes of trading, ICFC Finance Ltd surged 9.78 percent. The stock prices of Samling Power Company Ltd, Nirdhan Utthan Laghubitta Bittiya Sanstha Ltd, and Nepal SBI Bank Ltd increased by 8.21%, 3.43 percent, and 2.86 percent, respectively.

Sanima General Insurance Ltd and Sunrise Bank Ltd were likewise profitable at the conclusion of the day.

All other traded equities ended in the red, with Himal Power Partner Ltd and Manushi Laghubitta Bittiya Sanstha Ltd suffering the worst losses, both falling by over 8%.

Prime Life Insurance Company Ltd, Mahalaxmi Bikas Bank Ltd, and Joshi Hydropower Development Company Ltd all saw their stock prices fall by more than 7%. Stocks in the oil sector, in particular, have plummeted.

Formation of a firm bearish candlestick, in terms of ARKS technical analysis, reflects weakness in the market. A breach of the 2,680 support was also visible indicating possibility of further correction towards psychological 2,600 mark.

Both MACD and RSI are pointed downwards reflecting loss of momentum and sellers control in the equity market.

This column is produced by ARKS Capital Advisors Ltd.

(Views expressed in the article are those of the producer and do not necessarily reflect those of this publication)

source: myrepublica

Top comments (0)